Analysis of Trades and Trading Tips for the British Pound

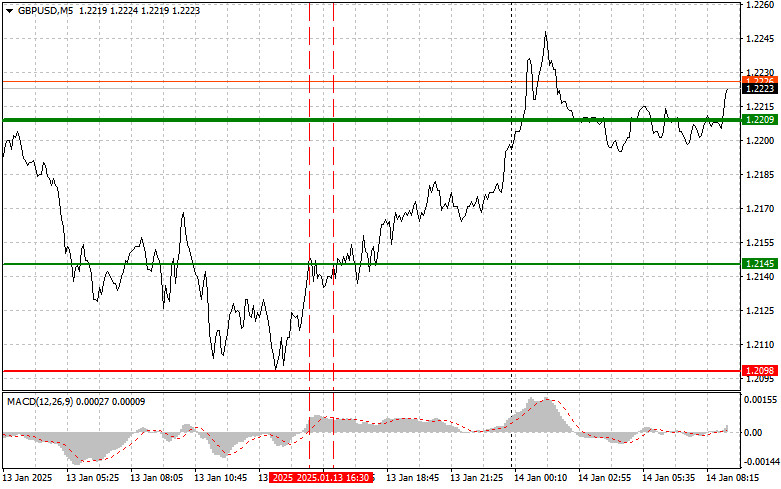

During the afternoon, the initial test of the 1.2145 price level coincided with the MACD indicator being significantly above the zero mark, which limited the pound's upward potential. As a result, I chose not to make a purchase. Shortly after, another test of the 1.2145 price occurred while the MACD was in the overbought zone, leading me to implement Scenario #2 for selling. Unfortunately, there was no significant downward movement afterward, resulting in recorded losses.

The pound rose sharply following rumors that members of newly elected President Donald Trump's economic team were discussing plans for gradual tariff increases. Such gradual tariff hikes would allow businesses to adapt to the changes, reducing the risk of sudden economic shocks. Economists point out that this approach could help limit inflation growth in the U.S., potentially allowing the Federal Reserve to reconsider discussions on lowering interest rates.

Today, Sarah Breeden, the Deputy Governor of the Bank of England for Financial Stability, is expected to deliver a speech that will likely address the current state of the country's financial system and its future prospects. In light of global economic changes and instability, it is essential to understand how the central bank maintains stability and safeguards financial markets from potential risks. Breeden's speech may cover topics such as monetary policy, inflation, and changes in interest rates. Given the recent economic fluctuations, her comments will be especially relevant for investors and traders. She is anticipated to share her insights on how the bank's measures affect the real economy and the initiatives planned to sustain the country's financial health. A key focus will be on discussing new initiatives aimed at strengthening financial infrastructure and ensuring transparency within the banking system.

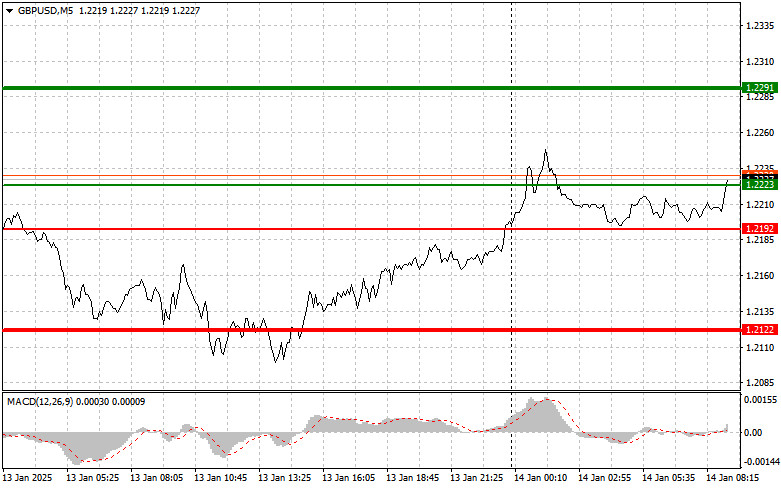

For my intraday strategy, I will concentrate on implementing Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound upon reaching the entry point near 1.2223 (green line on the chart) with a target of 1.2291 (thicker green line on the chart). Around 1.2291, I plan to exit purchases and open sales in the opposite direction (expecting a movement of 30–35 pips in the opposite direction). Expecting pound growth is reasonable only within a corrective framework. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.2192 price, with the MACD indicator in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. Growth toward the opposite levels of 1.2223 and 1.2291 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after breaking through the 1.2192 level (red line on the chart), leading to a quick decline in the pair. The key target for sellers will be the 1.2122 level, where I plan to exit sales and immediately open purchases in the opposite direction (expecting a movement of 20–25 pips in the opposite direction). Selling the pound at the highest possible levels is preferable to continue the forming bearish trend. Important! Before selling, ensure the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.2223 price, with the MACD indicator in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.2192 and 1.2122 can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.