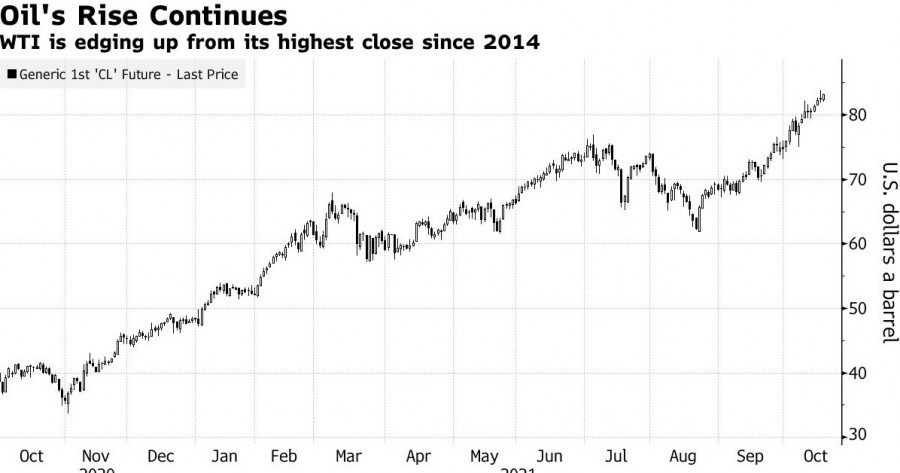

Oil continued to rise after closing the previous session at a new seven-year high as the US dollar fell and investors appreciated the energy crisis that shook world markets.

Futures on the New York Stock Exchange rose by 1.4% compared with calculations on Monday, which is the highest since October 2014. But the Bloomberg US dollar index fell by 0.3%.

Russia tightly controls gas supplies to Europe, and OPEC+ has not pumped enough crude oil to achieve its production target, which exacerbates the existing crisis of supplies to energy markets.

Oil prices have risen over the past eight weeks. The energy crisis caused by the shortage of natural gas and coal coincided with a recovery in demand in key countries that survived the pandemic. It is expected that in this quarter, many countries will seek to increase stocks in storage, which will lead to tension in the market. The energy crisis is already putting pressure on industrial output in Europe and Asia.

"As long as the global energy crisis continues, any decline in oil prices is likely to be seen as a buying opportunity," said Helge Andre Martinsen, a spokesman for DNB Bank ASA. According to him, coal in China reached a record high on Tuesday, which is a sign that the energy crisis is far from over.

Refineries in Asia are expected to raise prices this quarter. This will be a response to additional demand from the energy sector for petroleum products, although Chinese factories had previously lowered prices in September.

Another sign of demand in Asia is that Russian ESPO oil for shipment on the country's east coast was recently sold at the highest premium to the benchmark in Dubai since January last year.

Prices

- West Texas Intermediate shares for November delivery on the New York Mercantile Exchange at 8:51 am London time rose 0.4% to $ 82.80 a barrel.

- Brent with settlements in December added 0.2% to $ 84.52.

Russia has made it clear that it will not do its best to offer additional gas to European consumers if it does not receive approval for the start of deliveries via the Nord Stream-2 gas pipeline. Gazprom's gas exports to its main markets fell in the first two weeks of October to the lowest level since 2014 for the time of year. In exchange for increased supplies, Russia wants to get approval from regulators in Germany and the European Union to start using the pipeline to Europe.

With an emphasis on this point, the pipeline operator said on Monday that its first pipe is filled with so-called technical gas and is ready for commissioning, although it cannot supply it until regulatory approval is obtained.

The announcement came just hours after gas prices in Europe rose sharply following news that Gazprom had again applied for only a small amount of capacity to deliver fuel to Europe via other routes.

As rising fuel prices have led to increased pressure on the manufacturing sector, pressure from European governments has increased on Russia, Europe's largest supplier, forcing it to pump more. Additional Russian gas is seen as the main way to avoid an even more serious supply crisis in the middle of winter.

But due to the fact that relations with Europe have sharply frozen after years of sanctions and other tensions, the Kremlin does not want to do any favors.

"We can't come to the rescue just to compensate for mistakes we didn't make," Konstantin Kosachev, the main pro-Kremlin MP in the upper house of parliament, said in an interview, without specifying what Russia was seeking. - We fulfill all our contracts, all our obligations. In addition, additional voluntary and mutually beneficial agreements should be concluded."

According to the Oxford Institute for Energy Research, although exports to Europe have increased this year compared to last year's level, it lags behind the indicators of 2019. In October, daily flows fell, and Gazprom was in no hurry to replenish its warehouses in Europe, which increased pressure on prices. Russia blamed the crisis on a too hasty transition to spot markets and alternative energy sources.

At an energy conference in Moscow last week, President Vladimir Putin seemed to suggest that Russia could offer more gas. But he also lamented the slow progress in getting approval for Nord Stream 2, a process that could take until next year.

"If we could increase supplies along this route, it would significantly reduce tensions in the European energy market," Putin said. "However, we cannot do this yet because of administrative barriers."

One of his priority projects, the pipeline, has drawn criticism and sanctions from the United States, as well as attempts by Poland and Ukraine to block its completion.

German regulators are currently reviewing its certification application, but have said their initial decision may not be made until January, after which the European Commission will also have to give the go-ahead.

Russian officials have for months denied accusations that they deliberately held back gas supplies to Europe in order to obtain permission to use Nord Stream 2.

According to people close to the situation, after many years of tension in relations with Europe, the Russian authorities are unlikely to agree to increase gas supplies without strict guarantees that the new pipeline will be allowed to work. According to people, additional volumes will allow avoiding traditional routes through Ukraine.

It seems that we should not expect that the march of inflation in the EU countries will slow down. In Britain, the situation with the supply of fuel and other production components also causes difficulties. Most likely, Russia's tough position will not allow Europe to purchase inexpensive fuel, and its price will be shifted to the end user.