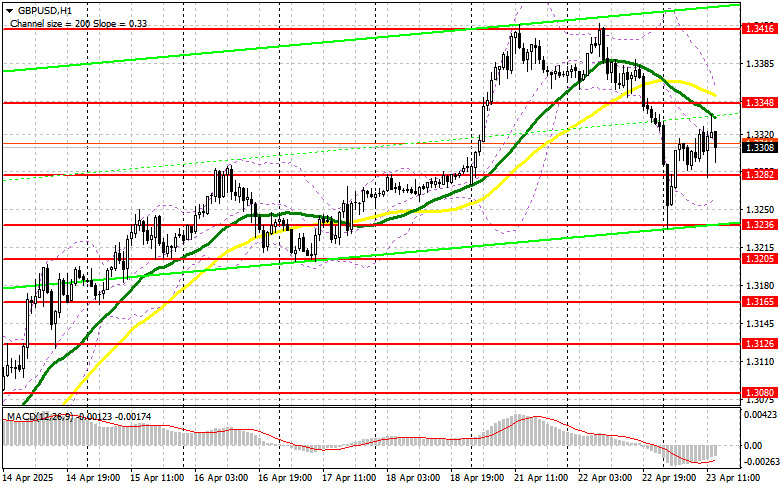

In my morning forecast, I drew attention to the 1.3304 level and planned to make market entry decisions from it. Let's look at the 5-minute chart and analyze what happened. A rise and false breakout around 1.3304 provided an entry point for short positions, but the pair didn't experience a significant drop. The technical outlook was adjusted for the second half of the day.

To Open Long Positions on GBP/USD:

Weak UK services PMI data for April pressured the pound but wasn't enough to push the pair even to the daily low. During the US session, bulls will have to rely on similarly weak data from the United States. PMI figures for the manufacturing and services sectors, as well as the composite index for April, are expected. In addition, speeches from FOMC members Austan D. Goolsbee and Christopher Waller are scheduled.

If the pair falls, I plan to act after a false breakout near the new support level at 1.3282, formed during the first half of the day. This will offer a good entry point for long positions, with the goal of recovering to the resistance at 1.3348—which has already proven difficult to break. Only a breakout and retest of this range from top to bottom will signal a new entry point for long positions, targeting an update of 1.3416, helping restore the bullish trend. The furthest target will be 1.3462, where I will take profit.

If GBP/USD declines and bulls fail to show activity at 1.3282 in the second half of the day, pressure on the pair will increase. In that case, only a false breakout around 1.3236 would be a suitable signal to open long positions. I plan to buy GBP/USD on a rebound from the 1.3205 support area, aiming for a 30–35 point intraday correction.

To Open Short Positions on GBP/USD:

Sellers made an appearance but weren't as strong as needed. Only a hawkish tone from Fed speakers and strong US PMI figures will help bears regain control. If the pound makes another upward move in the second half of the day, I will act around the 1.3348 resistance area, where the moving averages also pass, supporting sellers. A false breakout there will offer a short entry point, aiming for a decline toward the 1.3282 support.

A breakout and upward retest of that range would trigger stop-loss orders and open the path to 1.3236. The ultimate target will be 1.3205, where I plan to take profit. If demand for the pound returns in the second half of the day and bears remain inactive at 1.3348, it's best to delay shorts until the 1.3416 resistance—this week's high—is tested. I will only open short positions there on a false breakout. If there is no downward movement even there, I will look for short entries on a rebound from 1.3462, with a view to a 30–35 point correction.

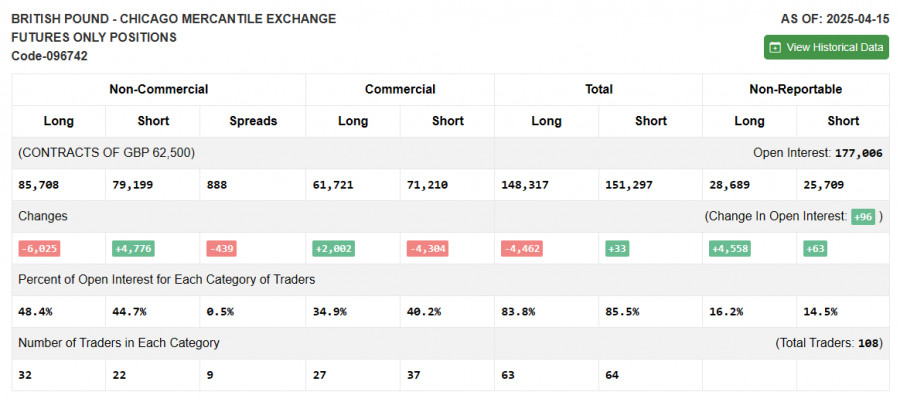

COT Report (Commitment of Traders) – April 15:

The latest COT report showed an increase in short positions and a decrease in long ones. Interestingly, the pound continues to rise confidently against the dollar despite this data. However, this report is lagging, and the recent GBP/USD rally is directly linked to Trump's tariff policy and dissatisfaction with Fed Chair Jerome Powell's performance—factors that weigh more on the dollar than support the pound. The latest report shows that long non-commercial positions fell by 6,025 to 85,708, while short non-commercial positions rose by 4,776 to 79,199. As a result, the gap between long and short positions narrowed by 439.

Indicator Signals:

Moving Averages Trading is occurring below the 30- and 50-period moving averages, which indicates a potential decline.

Note: The moving average periods and levels are based on the author's analysis on the H1 chart and may differ from traditional daily moving averages on the D1 chart.

Bollinger Bands If the pair falls, the lower boundary of the indicator near 1.3270 will serve as support.

Indicator Descriptions:

- Moving Average (MA) – Identifies the current trend by smoothing volatility and noise. Period 50 (yellow), Period 30 (green).

- MACD (Moving Average Convergence/Divergence) – Fast EMA: 12, Slow EMA: 26, SMA: 9.

- Bollinger Bands – Period 20.

- Non-commercial traders – Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific criteria.

- Long non-commercial positions – The total long open positions held by non-commercial traders.

- Short non-commercial positions – The total short open positions held by non-commercial traders.

- Net non-commercial position – The difference between short and long positions held by non-commercial traders.